Kunal Shah: The Fintech Entrepreneur Who Revitalized India

Introduction: The Visionary of CRED

Kunal Shah is a name that comes to mind while thinking of India’s startup nation. As the founder of CRED, he has revolutionized the way Indians manage credit and rewards.

However, success is a journey with his businesses that goes miles in excess of one startup alone. With a close understanding of consumer behavior, market forces, and the Delta 4 theory, Kunal Shah has created companies that address actual problems. His is a case study in resilience, innovation, and thinking out of the box.

Early Life and Education: A Non-Tech Founder With Bigger Thoughts

Born in Mumbai, Kunal Shah was a curious person. Unusual for tech entrepreneurs, he was not an engineer by origin. He had studied Philosophy at Wilson College, Mumbai, and that later found expression in his out-of-the-box thinking towards consumer behavior and business.

Although he had meager finances in the beginning of his life, Shah was interested in technology and startups. From such curiosity, he started studying different business models, eventually giving birth to entrepreneurial life.

From Freelancing to Founding Startups

Before stepping into the startup world, Kunal Shah was freelancing, and he would undertake design and website development work. Nevertheless, his entrepreneurial spirit compelled him to do something far greater. His first company, Paisaback, was a cashback and discounting portal. Even though it never became very big, it taught him how to work on something big—FreeCharge.

FreeCharge: The Game-Changer

FreeCharge, founded by Kunal Shah in 2010, was a site that allowed users to recharge their mobiles and get rewards. It was a success among Indian youth right from the start. The concept of offering cashback and rewards on every recharge made it highly interactive.

FreeCharge Success Story

- FreeCharge revolutionized the process of mobile recharges by making them reward-based and interactive.

- FreeCharge gained mammoth pace and had millions of users in just a span of a few years.

- In the year 2015, Snapdeal acquired FreeCharge for nearly $400 million, one of the largest startup exits of India.

- But with the acquisition, the pace of the platform slowed down without the direction of strategy from Snapdeal.

- Although things did not go quite so well following the acquisition, Shah had already established himself as a successful entrepreneur. But he wasn’t finished yet.

The Birth of CRED: A Billion-Dollar Fintech Revolution

Following quitting and investing in some startups, Kunal Shah returned in 2018 with the founding of CRED—a rewards platform for timely payment of credit card bills.

The Idea Behind CRED

Kunal Shah understood that India’s most creditworthy customers were overlooked when it came to receiving financial incentives. Banks were set to reward the masses, but holders of high credit scores were not given their rightful portion of incentives for their good money handling. CRED was formed to make a difference.

What Is Unique About CRED?

1. High Credit Score Users Only Club

Unlike nearly all other fintech apps, CRED is not for all. It’s just for individuals who have a brilliant credit score (750+), so it’s a high-end financial universe.

2. Wayward Credit Behaviour Incentives

Members who pay their credit card dues through CRED receive CRED coins, which help them unlock some incentives, offers, and discounts from top brands.

3. High-end User Experience

Through minimalist UI and gamification, CRED simplifies bill payments and money management. The user interface of the app has been hailed as simple yet premium in nature.

Kunal Shah’s Delta 4 Theory: The Formula for Successful Startups

One of the most interesting things about Kunal Shah’s ideas is his Delta 4 Theory. In his view, successful startups produce at least four times superior solutions to the current ones. If a solution is not 4x better, it won’t be able to induce a behavior change in customers.

How Delta 4 Theory Applies to CRED

- The conventional bill payments were boring and passive. CRED made them addictive and rewarding.

- It used to be cumbersome to manage credit cards, but CRED simplified it through intelligent tracking, reminders, and rewards.

- The element of exclusivity contributed to its luxury finish, so CRED was a highly coveted financial platform.

Kunal Shah’s Contribution to India’s Startup Culture

Apart from building startups, Kunal Shah is also a venture capitalist and mentor. He personally works with young entrepreneurs and has invested in more than 200+ startups like Razorpay, Unacademy, and Groww. His views on marketplace behavior, trust and building it, and scaling are worth gold in India’s startup ecosystem.

Key Takeaways from Kunal Shah’s Experience

1. Think Differently

Shah’s success is in finding nobody-else-goes gaps. Rather than coming up with mediocre solutions, he goes out and discovers distinctive, high-value issues.

2. Build for the Right Users

Rather than reaching everyone, he builds platforms for specific consumer bases, resulting in higher engagement and retention.

3. Focus on Long-Term Value

CRED’s business model was first criticized for spending money on rewards. But Shah does not focus on short-term profitability but long-term value creation. This has, in the long run, made CRED more trusted and stronger as a brand.

4. Solve for Trust and Credibility

From FreeCharge to CRED, Shah’s every business has been about creating consumer trust. His contention is that financial products need to focus on transparency and security in order to be successful.

Criticism and Challenges

As with any entrepreneur, Kunal Shah has also been criticized and faced challenges:

CRED’s profitability: CRED’s heavy cash burn on rewards has led critics to believe that its long-term viability is questionable.

Exclusivity factor: Some other individuals are of the view that restricting CRED to those with high credit scores isn’t helping with financial inclusion.

Revenue generation strategy: CRED’s revenue model was not defined in the beginning, but over time it launched premium lending offerings and financial products in order to drive revenue.

Even in the face of such adversity, CRED keeps evolving and growing up, testifying to the fact that Shah’s idea is robust.

The Future of CRED and Kunal Shah’s Legacy

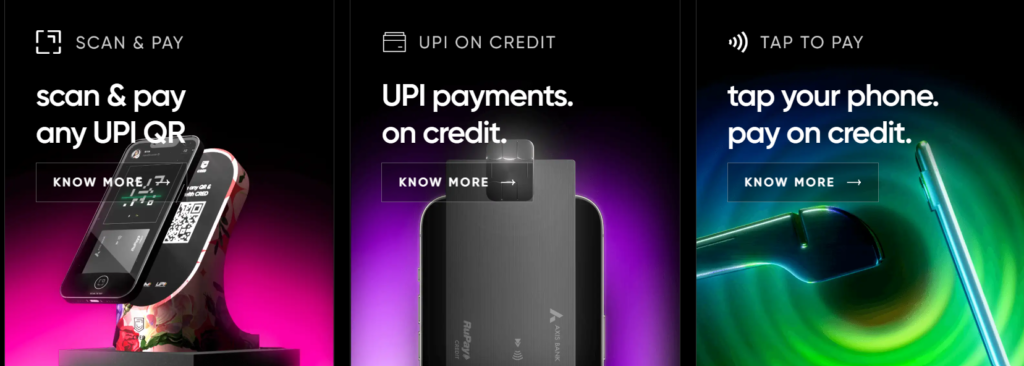

CRED is slowly moving beyond bill payments. It now has CRED Cash (instant loans), CRED Mint (P2P lending), and CRED Store (high-end deals). With increasing users and next-generation financial products, CRED will be a fintech champion in India.

And along with Kunal Shah, the journey has only started. Be it through CRED, investments in startups, or inciting tweets on Twitter, he will go on and make the future of entrepreneurship in India a page in history books.

Conclusion: A Trailblazer in Fintech and Beyond

Kunal Shah is a tale of innovation, resilience and vision. From Free Charge to CRED, he has revolutionized companies and built products that have reshaped consumer experience. His vision and think-out-of-the-box approach make him the actual game-changer of the Indian startup ecosystem.

Aspiring entrepreneurs can learn from his ability to identify problems, create compelling solutions, and build businesses that people love. Whether you’re a startup enthusiast, a fintech professional, or simply someone who admires innovation, Kunal Shah’s journey is nothing short of inspiring.

2 thoughts on “Kunal Shah: The Fintech Entrepreneur Who Revitalized India”