CRED: Smart Method to Pay Credit Card Bills | Smart Marketing

Introduction

Credit card bill payment can be so annoying sometimes, but with CRED, it’s a piece of cake and profitable too. CRED is an Indian fintech start-up that compels users to pay credit card bills and get rewards too. CRED was created by Kunal Shah and is a hit app among price-sensitive users. So, let’s dive into CRED’s world and find out what makes CRED so special!

The Story Behind CRED

CRED was founded in 2018 by FreeCharge’s founder, Kunal Shah. He wished to begin a platform where users would be rewarded for being financially prudent. CRED enables its users who possess a good credit rating (usually over 750) to pay their credit card dues with ease and earn CRED coins. CRED coins can be used to redeem special offers, discounts, and deals.

How Does CRED Work?

Working with CRED is easy. Just follow the easy step-by-step below:

Sign Up & Verification: Download the CRED app and sign up using your mobile number. The app verifies your credit score before giving access.

Link Credit Cards: After verification, you can connect multiple credit cards with the app.

Pay Bills: You can pay your bills via UPI, net banking, or any other method.

Earn Rewards: You receive CRED coins when you pay your bill and can use them as cashback rewards and discounts.

Features That Set CRED Apart

CRED is more than a bill pay app. It has some unique features:

1. CRED Coins & Rewards

You receive CRED coins when you pay your credit card bill. You can use these coins to get shopping discounts, travel discounts, restaurant discounts, and lots more.

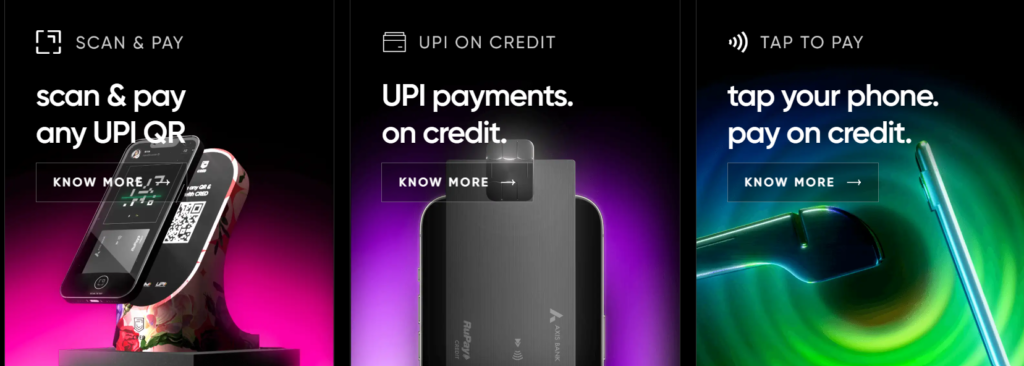

2. CRED Pay

CRED Pay allows you to pay for certain partner brands using your CRED coins, and that makes shopping simpler.

3. CRED RentPay

Did you wish to pay rent using your credit card? CRED RentPay makes that possible so that you could also earn rewards on rent payment.

4. Credit Score Monitoring

Free credit score checks by CRED so that you could possibly watch your finances and make sure that the financial history you are building is healthy.

5. CRED Stash

Need a loan in case of an emergency? Get pre-approved credit by verified users on CRED Stash at modest rates.

CRED’s Business Model – How does it make money?

CRED doesn’t charge any money to users for repayment. Instead, it earns money through:

- Brand Partnerships – Companies are compensated for promoting their offers on CRED’s platform and for making their products more visible to high-credit-score customers.

- Financial Services – CRED earns money from financial services such as insurance and personal loans.

- Transaction Fees – RentPay, for instance, makes a tiny transaction fee for leasing payment through credit cards.

Security Features in CRED

As CRED works with financial information, security comes first. Some of the standout features are:

- Data Encryption – User data is encrypted to keep the transaction safe.

- Two-Factor Authentication (2FA) – Additional security measures prevent unauthorized access.

- Secure Payment Gateway – Transactions are made through trusted payment gateways, minimizing risks.

The Role of CRED in Credit Card Users

CRED has transformed the way individuals manage credit cards. Here’s why:

- Incentivizes On-Time Payments – The reward mechanism encourages users to pay on time, raising their credit scores.

- Improves Financial Awareness – Features such as credit score tracking enable users to make informed financial choices.

- Eliminates Payment Troubles – An app for managing more than a card is time and effort-saving.

Marketing Strategies of CRED

CRED has been famous for its creative and out-of-the-box marketing campaigns. Some of the strategies are:

- Celebrity Endorsements – CRED utilized celebrities like Rahul Dravid and Kapil Dev in advertisements.

- Comedic Campaigns – They have funny, entertaining advertisements which differentiate them from the rest.

- Referral Programs – It forces its users to get other people, more rewards as the prize.

Issues Facing CRED

Despite the success of CRED, it has faced the following issues:

Limited User Base – Restricted to members with a good credit score, it has fewer users than a normal payment app.

Generating Revenues – It first expanded before concentrating on profitability.

Competition – The competition is increasing as other fintech players join the market.

The Future of CRED

CRED is extending further with its services, and in the future, it is going to do the following:

- More Products – Insurance, loans, and investments will be offered.

- Global Expansion – CRED can go global and enter markets abroad.

- AI-Driven Insights – Luxury AI can help users plan their budget better.

Conclusion

CRED has transformed the way we pay with credit cards and made it a pleasure. With its features of the new generation, simplicity, and money well-being focus, CRED can become even larger. If you possess a good credit rating, CRED is an application that you simply must try!

2 thoughts on “CRED: Smart Method to Pay Credit Card Bills | Smart Marketing”